Please refer to important disclosures at the end of this report

1

CLEAN SCIENCE AND TECHNOLOGY LTD. (CSTL) is a globally focused entirely on

developing newer technologies using in-house catalytic. It manufactures

functionally critical specialty chemicals such as Performance Chemicals (MEHQ,

BHA and AP), Pharmaceutical Intermediates (i.e., Guaiacol and DCC), and FMCG

Chemicals (i.e., 4-MAP and Anisole). Within 17 years of incorporation, it has

grown to be the largest manufacturer globally of MEHQ, BHA, Anisole and 4-MAP,

in terms of installed manufacturing capacities.

Positives: (a) Track record of strategic process innovation through consistent R&D

initiatives (b) Experienced Promoters and senior management with extensive

domain knowledge. (c) Strong and long-standing relationships with key customers

(d) Automated manufacturing facilities with proven design and commercialization

capabilities and strong focus on EHS. (e) Strong and consistent financial

performance in the last three Fiscals.

Investment concerns: (a) Operations are dependent on R&D capabilities and an

inability to continue to design catalytic processes may adversely affect the business.

(b) Intellectual property may not be adequately protected, may have a material

adverse impact on the business (c) A significant portion of its revenue is generated

from certain key customers. (d) A significant proportion of revenues are derived

from sale of MEHQ & any reduction in the demand for MEHQ could have an

adverse effect on business.

Outlook & Valuation: CSTL’s revenue has grown at CAGR of 9.1% over FY19-21

on the back of strong 22% top line growth in FY21 despite the Covid 19 crisis.

Moreover the company has posted strong EBITDA and PAT CAGR of 23.6% and

26.3% respectively during the same period. Given strong financial performance,

industry leading margins and returns ratios CSTL should be able to command a

premium to peers. We believe that the India specialty chemical industry is going to

be one of the biggest beneficiaries of shifting of supply chains post the Covid-19

pandemic. Given CSTL’s financial performance, industry leading returns ratios and

favorable outlook for the industry we recommend “SUBSCRIBE” to the issue.

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

393.3

419.3

512.4

% chg

-

6.6

22.2

Net Profit

97.7

139.6

198.4

% chg

-

43.0

42.1

EBITDA (%)

34.7

44.2

50.5

EPS (Rs)

9.2

13.1

18.7

P/E (x)

97.9

68.5

48.2

P/BV (x)

35.1

27.9

17.7

ROE (%)

35.9

40.8

36.8

ROCE (%)

43.4

48.3

43.3

EV/EBITDA

70.1

51.6

36.9

EV/Sales

24.3

22.8

18.6

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: July 07, 2021

Issue Close: July 09, 2021

Offer for Sale: 1.71-1.75 cr sh

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 78.5%

Others 21.4%

Fresh issue: 0 cr sh

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `10.6 cr

Post Issue Shar eholding Pattern

Post Eq. Paid up Capital: `10.6cr

Issue size (amount): `1546.6 cr

Price Band: `880-900

Lot Size: 16 shares and in multiple thereafter

Post-issue mkt. cap: * `9347 cr - ** `9559 cr

Promoters holding Pre-Issue: 94.6%

Promoters holding Post-Issue: 78.5%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Clean Science & Technology Ltd.

f

IPO Note Clean Science

July 06, 2021

Clean Science & Technology Ltd | IPO Note

July 06, 2021

2

Company background

Company was incorporated as ‘Sri Distikemi Private Limited’ on November 7,

2003 in Pune, Maharashtra. Name changed to ‘Clean Science and Technology

Private Limited’ with fresh certificate of incorporation, dated August 25, 2006. It

manufactures functionally critical specialty chemicals such as Performance

Chemicals & Pharmaceutical Intermediates. Company has grown to be the largest

manufacturer globally of MEHQ, BHA, Anisole and 4-MAP, in terms of installed

manufacturing capacities as of March 31, 2021.

Issue details

The issue comprises of offer for sale of upto `1546.63 crore in the price band of

`880-900.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

100,540,960

94.7

83,356,293

78.5

Public

5,678,000

5.3

22,862,667

21.5

Total

106,218,960

100.0

106,218,960

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

To carry out the Offer for Sale of up to ₹1,546.6 Cr by the Selling

Shareholders.

Achieve the benefits of listing the Equity Shares on the Stock Exchange.

Key Management Personnel

Pradeep Ramwilas Rathi, is the Chairman and Non-Executive Director of our

Company. He holds a bachelor’s degree in science from University of Poona and

master’s degree of science in chemical engineering practice from Massachusetts

Institute of Technology, USA.

Ashok Ramnarayan Boob, is the Managing Director of our Company. He holds a

bachelor’s degree in chemical engineering from the Institute of Chemical

Technology, Mumbai. He has close to 25 years of experience in the chemical

industry and has previously worked as an executive director at Mangalam Drugs

and Organics Limited.

Siddhartha Ashok Sikchi, is a Wholetime Director of our Company. He holds a

master’s degree in science from the University of Manitoba, Canada and a

bachelor’s degree in technology from the Institute of Chemical Technology,

Mumbai. He has over fourteen years of experience in the chemical industry.

.

Clean Science & Technology Ltd | IPO Note

July 06, 2021

3

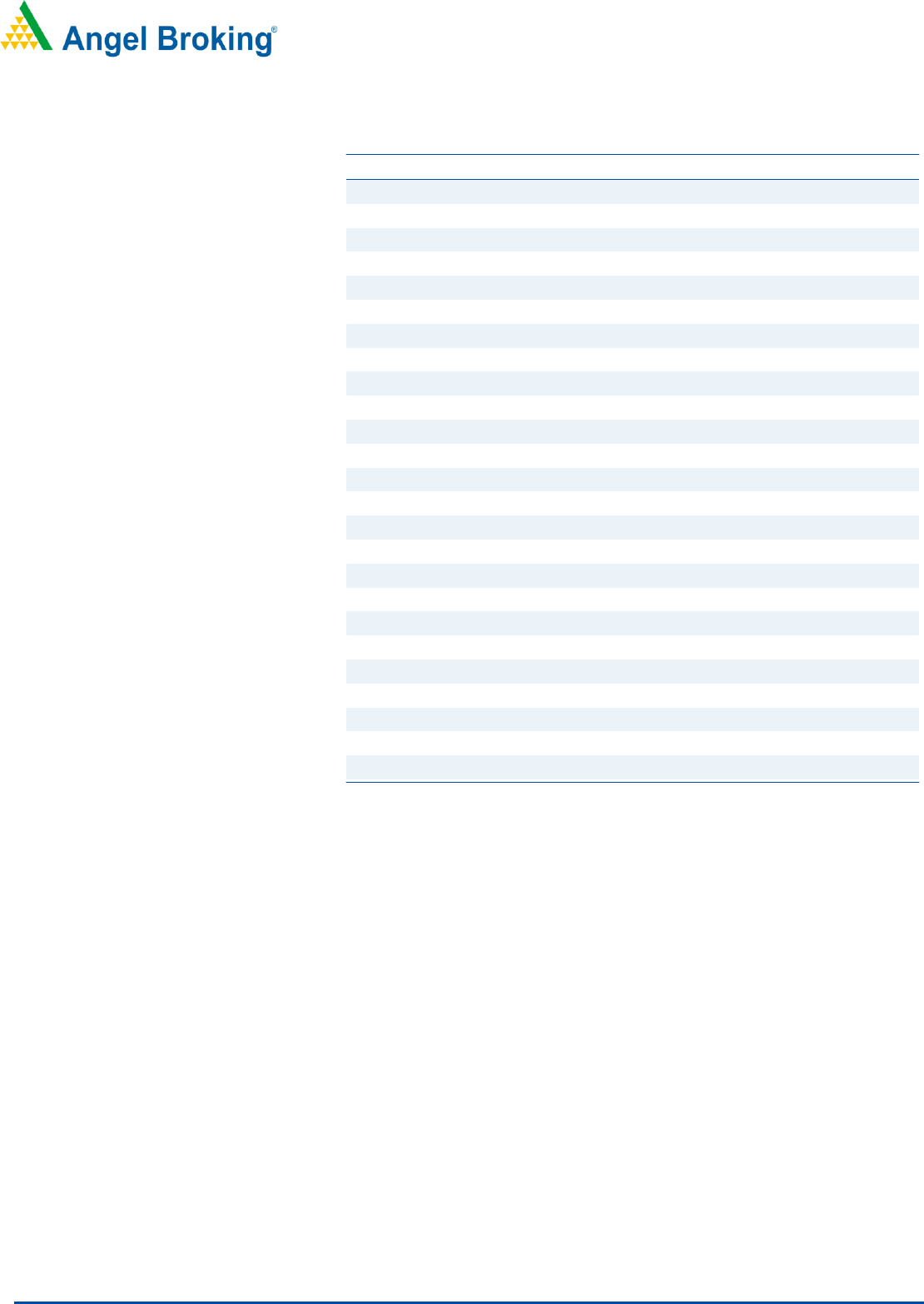

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` Cr)

FY2019

FY2020

FY2021

Total operating income

393.3

419.3

512.4

% chg

-

6.6

22.2

Total Expenditure

257.0

234.0

253.5

Cost of materials consumed

178.61

127.98

137.86

Changes in inventories

-7.39

1.26

-14.28

Employee benefits expenses

24.86

31.01

43.56

Other expenses

60.88

73.76

86.33

EBITDA

136.3

185.3

259.0

% chg

-

35.9

39.8

(% of Net Sales)

34.7

44.2

50.5

Depreciation& Amortisation

11.0

13.7

17.2

EBIT

125.3

171.6

241.7

% chg

-

37.0

40.9

(% of Net Sales)

31.9

40.9

47.2

Finance costs

0.0

0.1

0.1

Other income

11.3

10.9

25.6

(% of Sales)

2.9

2.6

5.0

Recurring PBT

136.5

182.3

267.3

% chg

-

33.5

46.6

Exceptional item

-

-

-

Tax

38.9

42.7

68.9

PAT (reported)

97.7

139.6

198.4

% chg

-

43.0

42.1

(% of Net Sales)

24.8

33.3

38.7

Basic & Fully Diluted EPS (Rs)

9.2

13.1

18.7

Source: Company, Angel Research

Clean Science & Technology Ltd | IPO Note

July 06, 2021

4

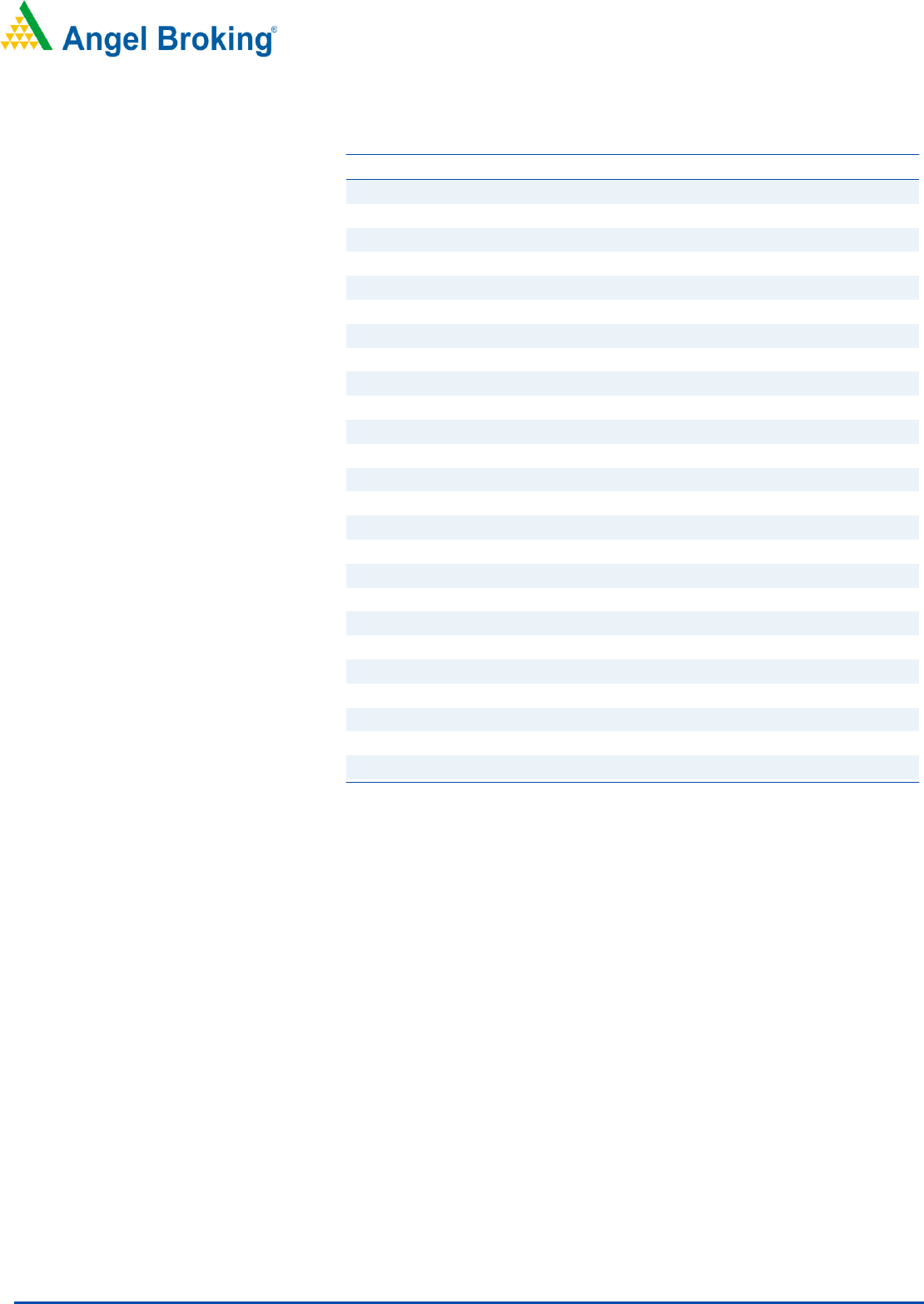

Exhibit 2: Consolidated Balance Sheet

Y/E March (` Cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

1.4

1.3

10.6

Other equity (Retained Earning)

270.6

340.8

529.0

Shareholders’ Funds

272.1

342.1

539.7

Total Loans

2.6

2.7

0.3

Other liabilities

14.2

10.5

17.9

Total Liabilities

288.8

355.3

557.9

APPLICATION OF FUNDS

Property, plant and equipment

124.9

162.6

182.6

Capital work-in-progress

3.9

3.4

55.0

Right-of-use asset

1.9

2.7

3.0

Other intangibles assets

0.2

0.3

0.3

Current Assets

192.6

257.0

395.1

Inventories

37.0

34.6

52.9

Investments

75.2

133.0

232.1

Trade receivables

59.8

69.8

74.2

Cash and cash equivalents

9.4

9.2

9.3

Bank balances other than (iii) above

0.0

0.1

6.3

Loans

-

0.2

0.2

Other financial assets

4.4

6.1

9.5

Other current assets

6.7

4.0

10.5

Current Liability

38.6

74.6

102.0

Net Current Assets

153.9

182.5

293.2

Other Non-Current Asset

4.0

3.9

23.9

Total Assets

288.8

355.3

557.9

Source: Company, Angel Research

Clean Science & Technology Ltd | IPO Note

July 06, 2021

5

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

Operating profit before working capital changes

141.2

189.4

273.7

Net changes in working capital

-20.9

13.1

-14.9

Cash generated from operations

120.3

202.5

258.8

Direct taxes paid (net of refunds)

-35.5

-42.4

-65.9

Net cash flow from operating activities

84.7

160.1

192.8

Bank deposits placed during the year

-0.3

-0.1

-21.4

Sale proceeds from property, plant and equipment

0.1

-

0.4

Others

-94.8

-106.2

-165.8

Cash Flow from Investing

-95.0

-106.3

-186.8

Long-term borrowings (repaid) during the year

-0.4

0.2

0.0

Proceeds of short-term borrowings (net)

2.5

-0.1

-2.4

Interest paid

0.0

-0.1

-0.1

Buyback of equity shares

-

-49.1

-

Tax on buyback of equity shares

-

9.1

-

Transaction costs of increase in share capital

0.0

0.0

-0.1

Other Financing activity

-12.8

-15.3

-3.3

Cash Flow from Financing

-10.8

-55.4

-5.9

Inc./(Dec.) in Cash

-21.1

-1.6

0.2

Opening Cash balances

29.5

9.4

9.2

Forex Difference

1.0

1.4

0.0

Closing Cash balances

9.4

9.2

9.3

Source: Company, Angel Research

Clean Science & Technology Ltd | IPO Note

July 06, 2021

6

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

97.9

68.5

48.2

P/CEPS

88.0

62.3

44.3

P/BV

35.1

27.9

17.7

EV/Sales

24.3

22.8

18.6

EV/EBITDA

70.1

51.6

36.9

Per Share Data (Rs)

EPS (Basic)

9.2

13.1

18.7

EPS (fully diluted)

9.2

13.1

18.7

Cash EPS

10.2

14.4

20.3

Book Value

25.6

32.2

50.8

Returns (%)

ROE

35.9

40.8

36.8

ROCE

43.4

48.3

43.3

Turnover ratios (x)

Receivables (days)

55.5

60.8

52.9

Inventory (days)

34.4

30.1

37.7

Payables (days)

20.7

31.1

43.4

Working capital cycle (days)

69.1

59.8

47.1

Source: Company, Angel Research

Clean Science & Technology Ltd | IPO Note

July 06, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.